Have you ever wondered how Spotify managed to secure those pivotal deals with major record labels like Warner, Sony, and Universal? This chapter will offer you a different perspective, from a small startup that didn't have abundant funding or the luxury of hosting unlicensed content. I'll share our journey and lay out insights that could be useful if you're considering striking a deal in the music industry.

Ready to dive in? Let's hit play.

Winning our first copyright dispute

Picking up from where we left off in Part 1, we sent legal notices to both Google and the record label that had reported us. They finally accepted our request, and our app was back in operation. This first issue gave us a taste of how the music industry works, and we learned that navigating the complex world of music copyrights would be challenging. It can be a make-or-break issue for startups. If you can't demonstrate efficient mechanisms for copyright protection, record labels will be hesitant to even start discussions, beyond the risk of facing potential copyright infringement lawsuits.

Entering an accelerator: Lanzadera

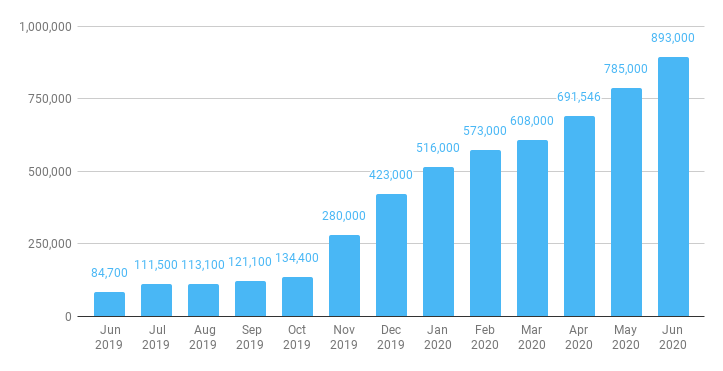

We had a major win when we got accepted into Lanzadera, one of the best Spanish accelerators at the time. Tears filled my eyes the moment I found out we had been accepted. At that time, this meant we had secured our startup's survival at least for nine months, contingent on meeting certain growth milestones—which we later achieved. This boosted our credibility, and our user base soared from 5,000 to 70,000 monthly active users. Before completing the program, we secured a pre-seed investment round with angel investors.

The catch was that we still needed a music catalog extensive enough to retain our newly acquired audience.

The Music Industry

The three major record labels—Warner, Sony, and Universal—control approximately 80% of the music you stream.

When Spotify first entered negotiations with record labels, both the business context and the pricing structures differed from what they are today. Over time, the industry has warmed up to partnerships with startups, though finalizing agreements remains a complex task. Watching that scene in the Netflix series 'The Playlist,' where the new lawyer discusses what it would be like to close a deal with the record labels, I deeply related to the situation.

The playlist - Episode 3 - The law

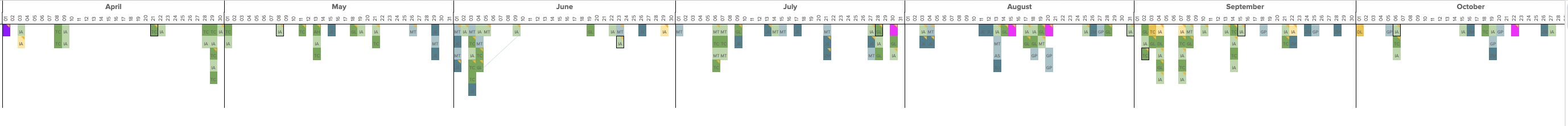

We started negotiating in 2020, and by October 2022 we had exchanged more than 200 emails and 10 meetings. Still no deal. Here’s why 👇

A labyrinthine puzzle of equity, advance payments, and country-specific regulations

The complexities surrounding music licensing agreements can be bewildering, especially for startups navigating this intricate landscape for the first time. We initially entered into negotiations with Warner Music Group, whom we perceived as being more agile and open to working with startups. Nevertheless, the negotiations were far from straightforward. A deal to license music for a music streaming platform has several key aspects:- Upfront Money & Minimum Guarantees: Acting as an assurance that you're serious about the partnership and they will generate at least that amount of money if they sign with you.

- Equity Stake: Labels require an ownership stake in your company. They know your company will be worth much more with their catalog, and they want to profit from it. Warner Music Group sold its entire stake in Spotify’s IPO, generating about $504 million. Sony Music also sold a portion of its Spotify shares for approximately $768 million.

- Per-Stream and Per-Subscriber Minimum Payouts: These payments are often broken down by country, requiring companies to manage complex regional payment schemes. Our platform had a strong ad-based component, and CPMs (what you earn for every thousand impressions you display) can vary a lot from one country to another. We had to be extremely careful, otherwise we could sign a non-sustainable deal, without any margin left for us.

- Minimum Editorial Share: This refers to the agreed-upon minimum percentage of content from the label that will appear in curated playlists or promotional spots.

- Most Favored Nation (MFN) Clauses: These are particularly challenging as they ensure that if a better deal is struck with another party, the terms are retroactively applied to the existing contract.

- And more, including compliance with content guidelines, data sharing provisions, and other intricate legal terms.

Source: The Verge, from a leaked contract between Spotify & Sony Music

Besides negotiating with major labels for the master recording rights, you also have to strike separate agreements with Collective Management Organizations (CMOs) and Performing Rights Organizations (PROs) for each country in which you operate. These organizations manage different kinds of music rights, adding another layer of complexity.

Innovating from the gaming industry

During the boom of free-to-play mobile games and the evolution of sophisticated mobile ads, most music streaming platforms were still focusing primarily on subscription-based revenue. A Spotify premium user was generating roughly 10 times more revenue than a free user. We saw an opportunity to do things differently.

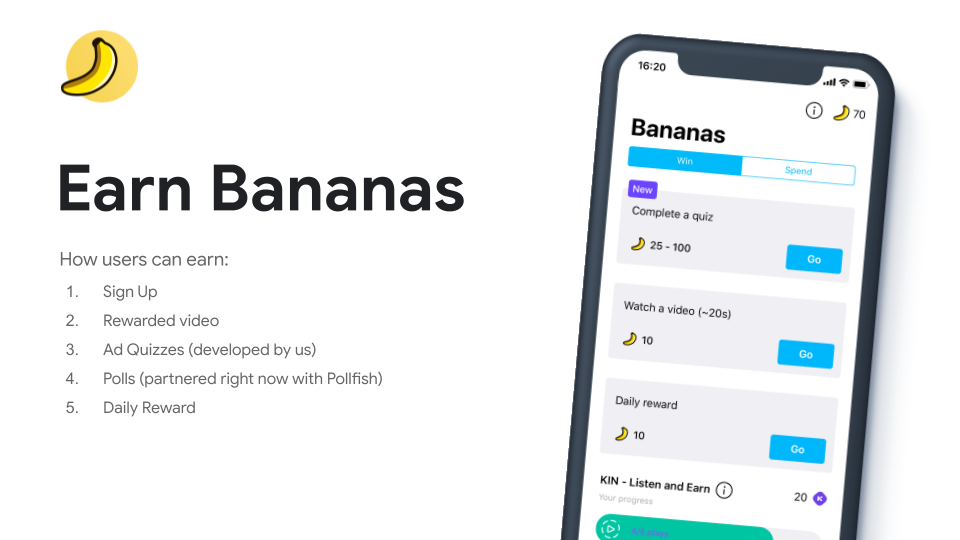

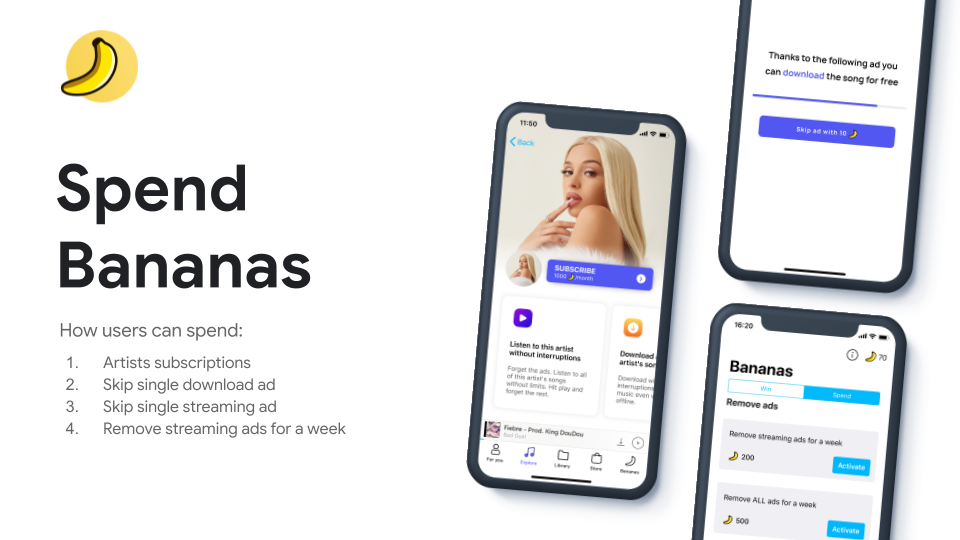

Our original business model permitted users to download songs for free, but with some restrictions and strategically placed advertisements. We drew inspiration from mobile gaming to introduce a full-fledged virtual economy within the app, featuring a virtual coin system. This virtual currency is a common feature in gaming apps, used to lower the entry barrier for in-app purchases or to introduce upselling opportunities in a more fluid manner. We also utilized it to incentivize valuable user actions, such as referring new users to the platform.

We even created a new ad format called AdQuiz: A rewarded quiz system that let users earn virtual coins on completion. Initial data showed that AdQuiz had promising conversion rates when compared to traditional ad formats and was a way to tap directly to premium advertisers.

However, our unique and less restrictive model was a sticking point during negotiations with major record labels. In the beginning, they expressed concerns that agreeing to our terms might set a precedent that could be used against them in future negotiations with larger platforms.

However, these initial concerns did not stop us from pursuing our vision.

Negotiating the licencing deal

At this stage, our team was already graced with the presence of some remarkable talent, including Ivet Anoro, one of the most gifted professionals I've encountered - who later succeeded me as CEO. Alongside our COO, Felip Costa, who played a crucial role in securing nearly 100 agreements with independent record labels, we began refining our strategy and outlining a plan to negotiate with each of the major record labels.

Warner emerged as a frontrunner in understanding our unique business model. Together, we crafted a draft agreement tailored to our platform, which included the economic logistics of implementing a virtual coin system. Moreover, we successfully completed Warner's stringent content delivery and security checks. Special acknowledgment goes to Adria Sarquella (CTO), Giorgio Pellero (Head of Engineer), Soren Rifé (Software Developer and later CTO), Guillem Budia (iOS Developer), Damià Fuentes (Android Developer), Arnau Rius (Front-End Dev) and Ricard Serrano for their contributions during this phase. It's worth noting that our lean team developed an in-house content delivery system for songs, comprehensive reporting tools for labels, as well as native Android and iOS apps and a web player.

At the same time, our negotiations with Sony started to heat up. As Warner was forwarding our proposal to their internal 'deal committee,' we made significant progress with Sony, culminating in a draft term sheet where the crucial elements were negotiated. Discussions with Universal remained in the early phases; however, finalizing agreements with either Warner or Sony would inevitably facilitate smoother negotiations with Universal.

Concurrently, we secured contracts with independent labels, accumulating a library of over 5 million licensed tracks. Although these additions didn't dramatically affect our performance indicators, they played a pivotal role in capturing the interest of major labels and generating momentum.

From June 2019, we increased our song catalog tenfold in one year. We later reached over 5 million tracks by 2022.

At that time, we had nearly 5 million app downloads but faced poor user retention due to a limited catalog. Securing a rich content library was vital for transforming our platform into a globally recognized streaming service with at least hundreds of thousands of monthly active users, without the need for additional investment.

As each month passed, our runway grew shorter, intensifying the urgency to finalize a deal and secure additional funding for future negotiations.

Unfortunately, after months of negotiating, Warner eventually rejected our initial offer, proposing a substantially higher fee for just some restricted territories. Although costly, it remained a potentially good deal when compared to some exorbitant upfront payments from other music platforms.

Given our dwindling cash reserves and growing reservations about Warner's willingness to finalize a deal promptly, we shifted our focus entirely to concluding negotiations with Sony.

Things were progressing well, albeit slowly, yet steadily. We reached the point where both parties engaged lawyers to draft the final agreement. Until something unexpected happened: the person with whom we had negotiated all terms at Sony had to step away for an indefinite period. Faced with the dilemma of waiting for her to return or starting anew with a different contact person. We opted to wait for a few months, until eventually we tried to transfer the negotiation to another representative. It was unsuccessful.

A snapshot of our email interactions and meetings with major record labels.

No deals, and not much money left in the bank. Is this the end?

Not yet. We were able to keep running partly because we had spotted the crypto trend before it became mainstream.

The Crypto wild west

Our in-app virtual currency, the "bananas," were not actually crypto tokens. At the time of their introduction, blockchain technology was not sufficiently advanced to make this feasible, and the gas fees associated with transactions were prohibitively high. Once the technology went further, our virtual economy provided a proof of concept for what could be achieved in bridging the realms of web3 and mainstream apps, driving token demand for crypto projects.

We were approached by one of the top 50 cryptocurrencies at the time, and finalized an agreement to execute a project with them. In exchange, we would receive payment in their cryptocurrency, an inherently volatile asset with the potential to either plummet to zero or skyrocket.

Can you guess which direction it went?

A year later, when the time came for the payout, the price went crazy up. Yet again, good news was preceded by a challenge: When the time came, they refused to honor their commitment to pay us.

This was an incredibly stressful period for me, featuring sleepless nights as I pondered solutions. The deal fell under my responsibility as CEO, and the company had already incurred expenses in anticipation of receiving the payment.

We were running out of cash, badly. Given the situation, I drafted a contingency plan to extend our runway and tighten our belts more than we ever thought possible. I'm forever grateful for the team's resilience and adaptability.

Yes, we were working literally in a garage.

Taking full responsibility for the situation, I consulted with Ivet Anoro about the possibility of her taking on the role of CEO. This would allow me to step down, concentrate on recouping the funds under the original agreement with the crypto project, and have a chance of flipping the situation.

She accepted the challenge, and we engaged with lawyers.

What comes next

Hang tight for the final act of this rollercoaster. I'll explore how events unfolded and discuss why our company's rebranding to OffBeat was more than just a name change. We executed the leadership transition and ended up backed by Outlier Ventures. More to come soon.